The smartphone has a number of major players these days, outside the familiar brands of Apple and Samsung. Huawei has been trying to cement itself as the second-largest brand, with successful pushes into Asian and European markets. But its position has been put into jeopardy due to Huawei’s ban from US markets and technology. Instead, the best-positioned contender comes from the lesser-known BBK Electronics.

BBK is a Chinese multinational corporation. It owns a number of popular brands across various consumer electronics markets, including headphones, Blu-ray players, and smartphones. It also oversees a number of major smartphone brands including one fan-favorite — Oppo, Vivo, Realme, and OnePlus.

Who is BBK?

BBK Electronics has been operating in various sections of China’s electronics industry since the 1990’s. Duan Yongping, a reclusive billionaire, spearheaded the company. After successfully generating more than 1 billion Yuan from the “Subor” gaming console, a competitor to the Nintendo Entertainment System, Duan left his position running a Chinese factory in 1995. He then started the company Bubugao, which would eventually become BBK. The company now owns factories spread over 10 hectares of land and more than 17,000 employees.

BBK Electronics began by manufacturing a range of CD, MP3, and DVD players, along with other household appliances. These appeared under a range of global brands. In 2004 Duan founded Oppo with CEO Tony Chen. Oppo built on Duan’s experience in the video market by selling DVD and Blu-ray players, before moving into the smartphone market.

Meet the BBK brands

Vivo was the first major BBK subsidiary. Founded by Duan and Vivo CEO Shen Wei in 2009. The first Vivo smartphones appeared in 2011 with a focus on ultra-slim form factors, while relying on celebrity endorsements to capitalize on the smartphone boom. Vivo’s core business is feature-packed mid-rangers, but has grabbed headlines in recent years with its experimental Apex concept phones and the Nex series.

Realme is a similar but much newer Oppo spin-off. It was established by Sky Li (born Bingzhong Li), previously the Vice-President of Oppo Electronics, on May 4, 2018. The brand originally appeared in China as Oppo Real back in 2010 before rebranding and entering a series of new markets, including Europe and India, in 2018 and 2019. Realme’s phones combine cutting-edge tech with affordable price tags. It even managed to snag our Best of Android 2019 award.

Duan didn’t start OnePlus either, the BBK brand that Western customers might be most familiar with. Instead, former Oppo vice president Pete Lau and co-founder Carl Pei set up the company in 2013. While OnePlus has the highest global profile of any of the BBK brands, it is still a subsidiary of Oppo, making it a subsidiary of parent company BBK too. OnePlus is also arguably the most premium brand of the bunch. However, it takes a different approach to Oppo and Vivo’s retail-based business model. OnePlus primarily targets online sales via platforms like Amazon, which has helped BBK enter European and US markets.

Second or third place, depending on who you ask

When it comes to smartphones, BBK Electronics is a big deal, even though most consumers have never heard of it. Oppo and Vivo have long been major players not just in the Chinese smartphone market, but internationally too. OnePlus and Realme are quickly adding additional markets and sales on top of the company’s Chinese stronghold.

In China, Oppo and Vivo have managed to surpass the growth rate of the once seemingly invincible Xiaomi by building a network of local stores, while its competitor focused on its efforts online. Apple and Samsung have struggled to keep pace with the cost-competitive nature of China’s homegrown mobile brands, including those in the BBK network.

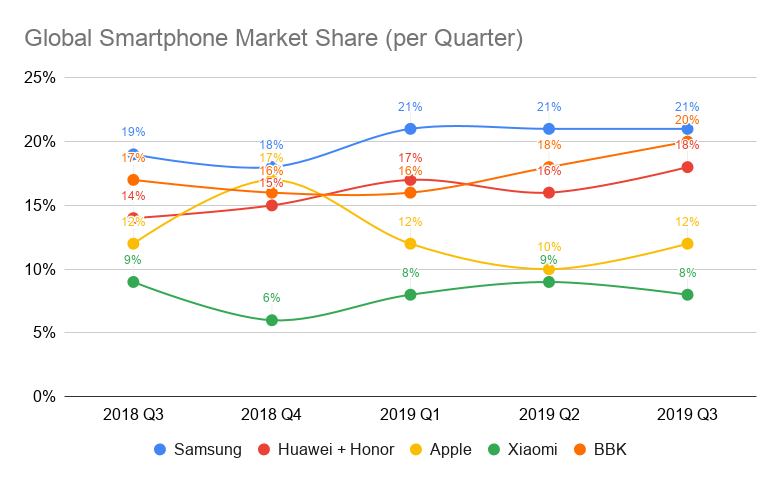

On a global scale, data from CounterPoint consistently places combined BBK brand market shares in second place towards the end of 2019. At the last count, BBK moves ahead of the combined might of Huawei and Honor and is right behind Samsung in terms of global shipments and share. Apple retains its second spot during its fourth-quarter new release surge. However, it is otherwise now fourth place in the global scheme of things.

Looking at the BBK brands individually paints quite a different picture. There’s a familiar first, second, and third-ranking for Samsung, Huawei, and Apple respectively. Oppo remains BBK’s largest individual brand and is only a couple of percentage points behind Apple for third place on its own.

The change in fortunes over the past couple of years is mostly due to the huge growth in markets such as China and India. Chinese brands have capitalized on their home markets and their value for money proposition has played well in India and Southeast Asian markets. Combined with aggressive marketing and investments in retail networks, India’s market leader Xiaomi has started feeling the pressure. Meanwhile, Apple and Samsung, in particular, are struggling to grow their brands in these markets and are instead reliant on their more traditional but stagnant bases.

Market estimates always have some margin of error, but the data shows a close race for second between BBK and Huawei in the grander, global picture. The two aren’t very far behind market leader Samsung now either. The 2020 rankings are all to play for.

Looking forward

BBK Electronics isn’t satisfied with just having a strong lead in China. The company is battling it out with Xiaomi for the top spot in India, which remains a key growth market. Meanwhile, Realme and OnePlus are broadening the company’s horizons outside of Asia. BBK also launched another brand named ikoo a few years ago. This smartphone sub-brand leverages experience in children’s educational electronic toys to create the world’s first education handset.

By spreading itself across multiple brands, BBK has managed to tailor its products to suit various market segments. The strategy has clearly paid off in China and is quickly growing across India and now in parts of Europe too. After all, the company is hard to ignore when it’s subsidiaries are pumping out devices like the OnePlus 7T and Realme X2 Pro.